Legal risk management is an essential aspect of running a successful business. It involves identifying potential legal risks and taking proactive measures to mitigate them, ensuring compliance with laws and regulations, and protecting the organization from legal liabilities. One crucial aspect of legal risk management is providing comprehensive training to employees, empowering them to make informed decisions and avoid legal pitfalls. In this article, we will explore the fundamentals of legal risk management and how to incorporate it into employee training programs.

Understanding the Basics of Legal Risk Management

In today’s complex business environment, legal risks can arise from various sources, including employment law, intellectual property issues, contract disputes, and regulatory compliance. To effectively manage these risks, it is crucial to have a solid understanding of the legal landscape that pertains to your industry and business practices.

By having a clear understanding of the legal risks your organization may face, you can implement proactive measures to prevent potential issues from arising. This may involve putting in place policies and procedures, conducting regular audits, and staying up to date with relevant legal developments.

An important aspect of legal risk management is the ability to identify potential risks before they escalate into legal disputes. By being proactive and taking preemptive action, organizations can save time, money, and reputational damage that may result from legal battles.

One area where legal risk management is particularly important is in employment law. With the ever-changing landscape of labor regulations, organizations must stay informed about their obligations and rights as employers. This includes understanding laws related to hiring practices, employee benefits, workplace safety, and discrimination. By having a comprehensive understanding of these laws, organizations can ensure compliance and minimize the risk of costly legal disputes.

Intellectual property issues also pose significant legal risks for businesses. From trademarks and copyrights to patents and trade secrets, protecting intellectual property is crucial for maintaining a competitive edge. Organizations must be aware of the laws and regulations governing intellectual property rights, as well as the steps they need to take to safeguard their own intellectual property and respect the rights of others. Failure to do so can lead to legal battles and damage to the organization’s reputation.

Contract disputes are another common legal risk faced by businesses. Whether it’s a disagreement over terms and conditions, breach of contract, or non-performance by one party, contract disputes can be time-consuming and costly. Effective legal risk management involves careful contract drafting, review, and negotiation to ensure that all parties are clear on their rights and obligations. It also requires ongoing monitoring and management of contracts to identify and address potential issues before they escalate into disputes.

Regulatory compliance is a critical aspect of legal risk management, particularly for businesses operating in heavily regulated industries such as finance, healthcare, and energy. Organizations must stay up to date with the ever-changing regulatory landscape and ensure that they are in compliance with all applicable laws and regulations. This may involve implementing internal controls, conducting regular audits, and training employees on compliance requirements. Failure to comply with regulations can result in fines, penalties, and reputational damage.

In conclusion, legal risk management is a vital component of any organization’s overall risk management strategy. By understanding the legal landscape, identifying potential risks, and taking proactive measures to prevent issues, businesses can minimize the likelihood of legal disputes and their associated costs. It is an ongoing process that requires continuous monitoring and adaptation to ensure compliance with laws and regulations. By effectively managing legal risks, organizations can protect their interests, maintain their reputation, and focus on achieving their business objectives.

Developing a Comprehensive Legal Risk Management Plan

A comprehensive legal risk management plan lays the foundation for effectively managing legal risks within your organization. It should include a thorough analysis of the potential legal risks your business may face and a strategic approach to mitigating those risks.

When developing a legal risk management plan, it is crucial to involve stakeholders from various departments, including legal counsel, human resources, finance, and operations. This ensures a holistic approach to risk management and allows for a better understanding of the potential legal implications across different areas of the business.

One important aspect to consider when developing a comprehensive legal risk management plan is conducting a risk assessment. This involves identifying and evaluating potential legal risks that your organization may encounter. These risks can vary depending on the nature of your business, industry regulations, and external factors such as economic conditions or changes in legislation.

During the risk assessment process, it is essential to gather input from key stakeholders and subject matter experts. This collaborative approach helps to identify risks that may not be immediately apparent and ensures that all perspectives are considered. By involving stakeholders from different departments, you can gain valuable insights into potential legal risks that may arise in their respective areas of expertise.

Once the potential legal risks have been identified, the next step is to prioritize them based on their likelihood and potential impact on the organization. This allows you to focus your resources on addressing the most critical risks first. Prioritization can be done through risk scoring or ranking, taking into account factors such as the probability of occurrence, potential financial impact, and reputational damage.

After prioritizing the risks, it is important to develop strategies and action plans to mitigate them. This may involve implementing preventive measures, such as creating and enforcing policies and procedures that promote legal compliance, or establishing internal controls to monitor and manage legal risks on an ongoing basis.

Furthermore, it is crucial to regularly review and update your legal risk management plan to adapt to changes in the business environment. This includes monitoring regulatory developments, industry trends, and emerging risks that may impact your organization. By staying proactive and continuously improving your risk management strategies, you can effectively protect your business from potential legal pitfalls.

In conclusion, developing a comprehensive legal risk management plan requires a collaborative effort involving stakeholders from various departments. It involves conducting a thorough risk assessment, prioritizing risks, and implementing strategies to mitigate them. By following these steps and regularly reviewing and updating your plan, you can ensure that your organization is well-prepared to navigate the complex legal landscape and minimize potential legal risks.

Incorporating Legal Risk Management into Employee Policies

Employee policies play a vital role in managing legal risks within an organization. Clear and well-communicated policies provide employees with guidance on how to conduct themselves and make decisions within the bounds of the law.

When creating employee policies, it is important to consider the specific legal risks associated with your industry and organization. Policies should address issues such as confidentiality, conflicts of interest, data protection, and ethical guidelines.

Furthermore, policies should be regularly reviewed and updated to reflect changes in laws and regulations. Training employees on these policies and providing them with the necessary resources and guidance ensures that they are equipped to make informed decisions that comply with legal requirements.

What to Cover in an Employee Training Program

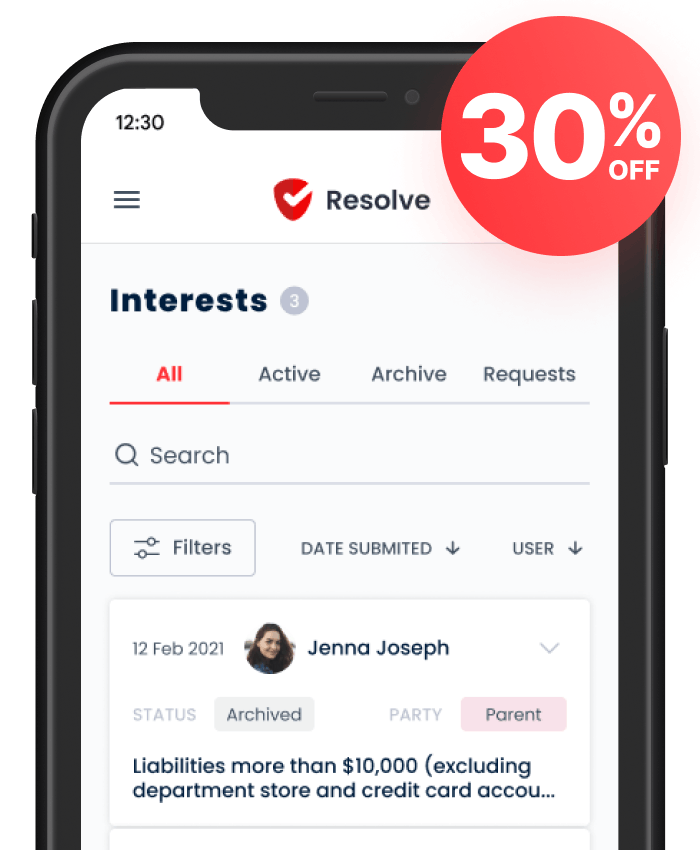

An effective employee training program should cover a wide range of legal topics relevant to your organization. This may include discrimination and harassment prevention, safety regulations, intellectual property rights, contract management, and data privacy laws.

Training programs should be tailored to employees’ roles and responsibilities, and should incorporate interactive and engaging activities to enhance the learning experience. Providing real-life examples and case studies can help employees understand the practical application of legal concepts within their day-to-day work.

Additionally, incorporating statistics and infographics can further reinforce key legal information and help employees retain important knowledge. Visual aids can make complex legal concepts more accessible and engaging, ensuring that employees are better equipped to recognize and manage legal risks.

In conclusion, legal risk management is a critical component of any organization’s success. By incorporating legal risk management into employee training programs, businesses can empower their employees to make informed decisions, mitigate legal risks, and ensure compliance with laws and regulations. Developing a comprehensive legal risk management plan, incorporating legal considerations into employee policies, and providing engaging and relevant training are key steps in creating a culture of legal compliance within an organization.