What is GRC, and How Does It Benefit Businesses? A Guide to Governance, Risk, and Compliance

When it comes to managing risk in a business, there is no one-size-fits-all solution. However, by implementing a GRC (Governance, Risk, Compliance) framework, businesses can identify, assess, and manage risks across their operations. In this article, we’ll take a closer look at what GRC is and how it can benefit businesses in the short and long term.

What is GRC?

GRC is a comprehensive framework that enables organisations to identify, assess, and manage risks related to their governance, operational processes, and compliance functions. Risks can be categorised in many ways but often fall into one of four main types: financial, compliance, operational, or strategic.

- Financial risks include things such as missed revenue targets or liquidity issues.

- Compliance risks relate to regulatory non-compliance or violations.

- Operational risks encompass failures in internal processes or systems, such as data breaches.

- Strategic risks are those that could impact the long-term viability of the company, such as a major market shift.

Benefits of GRC

When it comes to compliance and statutory obligations, businesses often have a lot of paperwork to deal with. This can include disclosures relating to political donations, gifts, personal interests, travel expenditure, and the use of business vehicles. Fortunately, there are solutions available that can automate these processes and make them more efficient. GRC software is one such solution. It helps businesses meet their compliance obligations and improve their customer experience.

GRC software automates the process of gathering data from different sources, such as email servers and databases. This data is then cleansed and consolidated into a central repository. This makes it easier for businesses to identify potential risks and comply with regulations. Therefore, compliance programs help organisations meet their regulatory obligations. They typically include policies, procedures, and training programs designed to ensure that employees understand their obligations and comply with applicable regulations.

GRC also helps businesses to better understand their customers. By consolidating customer data from different sources, businesses can gain a better understanding of who their customers are and what they want. This can help businesses to develop more effective marketing campaigns and improve customer service. A well-run GRC program can provide several benefits to businesses. In the short term, they can reduce risk by implementing best practices and controls. In the long term, they can help businesses preserve their brand reputation, enhance productivity, and protect their bottom line.

GRC solutions are used by a wide range of businesses – from small family firms to large multinational companies. The benefits of using a GRC solution are many and varied:

- Increased efficiency – GRC solutions automate previously manual tasks, reducing the time it takes to complete disclosure processes.

- Reduced costs – GRC solutions typically integrate with existing systems, so there is no need for businesses to purchase additional software or hardware.

- Improved customer experience – by automating disclosure processes, GRC solutions help organisations provide a fast, efficient and accurate service to their customers.

Considerations to Keep in Mind

When implementing a GRC strategy, it is essential to consider the specific needs of your organisation. There are a few key considerations you should keep in mind when starting:

1. Define your business goals and objectives

Before you can start implementing any risk management practices, you first need to define your business goals and objectives. What do you hope to achieve with your GRC program? Do you want to reduce risk exposure across all areas of your business? Enhance productivity? Preserve your brand reputation? By understanding what you hope to accomplish, you can better tailor your risk management strategies to fit your needs.

2. Assess your organisational structure and risks

Once you have defined your goals, it is important to assess the organisational structure and risks within your company. This will help you determine where to focus your efforts and identify any areas of potential vulnerability. You may also want to consider hiring a consultant to help you conduct a comprehensive risk assessment.

3. Establish governance and compliance standards

For GRC to be effective, it is important to establish governance and compliance standards for your organisation. These standards will provide a framework for managing risk across all areas of your business. They should be tailored to meet your company’s specific needs and updated as needed to reflect any changes in the risk landscape.

4. Implement risk management processes and procedures

Once you have established governance and compliance standards, it is time to start implementing risk management processes and procedures. These processes will help you identify, assess, and manage risks across all areas of your business.

5. Train employees on GRC practices

Finally, it is important to train employees on GRC practices to understand how they can contribute to the overall risk management effort. Employees should be aware of the risks within their area of responsibility and know how to respond effectively in the event of a crisis or incident.

The Bottom Line

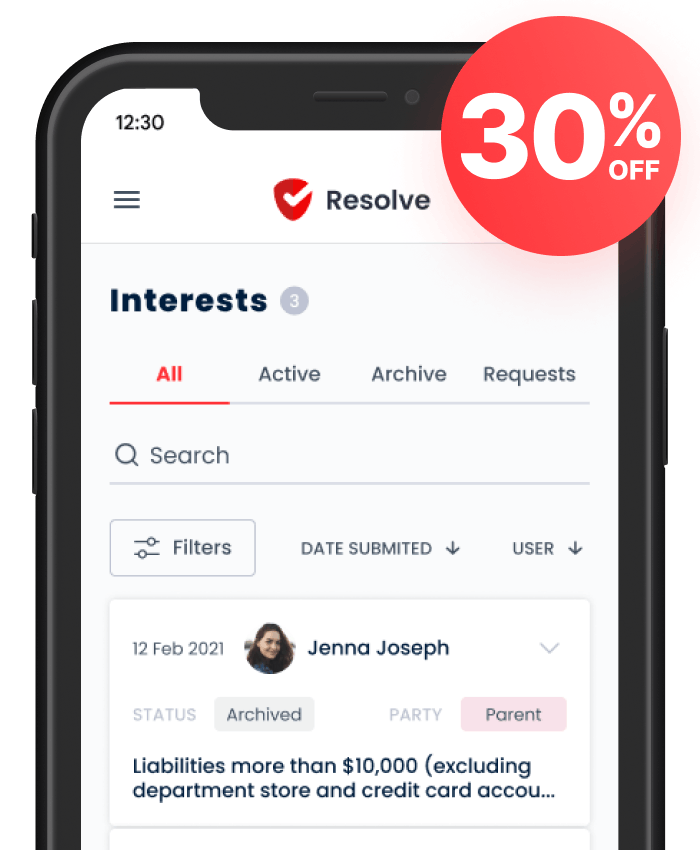

GRC is a critical part of any business, but manually managing all the financial compliance obligations can be challenging. That’s where Resolve comes in – with an easy-to-use gift, personal interest and expense reporting, you can be confident that your compliance obligations are taken care of. Resolve offers a comprehensive solution that makes managing compliance obligations easy. Sign up for a free trial today to see how our software can benefit your business. We are here to help you succeed – contact us with any questions or concerns.

Early Access Promotion

Keep your organization and employees 100% compliant. Save 30% on your first 6 months on any monthly plan.